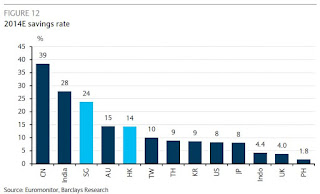

Most of us know the importance of saving. In fact, Singapore has one of the highest savings rate in the world. Whilst it is good to cultivate the habit of spending less than you earn (one of the basic fundamental in my life), it is equally important to make that dollar you save go the extra mile.

|

| 24% in 2014 Credit: Barclays Research |

Gone were the days when POSB offered a cool 4% for the money in your bank. The new savings rate norm these days are a miniscule 0.015% per annum. Personally, i have found some great alternatives to POSB and have never looked back since.

Here's what i do these days:

I typically switch my savings (or warchest) around between an Standard Chartered (eSaver) and a UOB (Uniplus) savings account. Both banks give a relatively decent promotional rate of 1.0%-1.4%. The caveat to enjoying these rate is that you would have to deposit fresh funds during the promotion - hence the 'switching'.

In 2015, i opened an OCBC360 account to make use of the 2.25% interest rate on your first $60,000. It is a guaranteed 2.25% as long as you giro-credit your salary, spend $500 on an OCBC Credit Card and pay 3 bills from the 360 account.

Through the above methods, i aim to achieve an annual effective savings rate of about 1.65%. Granted its not alot, but at least it beats letting that money sit idle in a POSB/DBS savings account.

Yours,

Dream Chaser

COMMENTS